The 10 Principles of Investing Safely

The following list outlines the principles of investing safely. Each point combines elements of strategy (decision-making), finance (investing), and operations (process) management; and all the site's pages are related to these guidelines.

- YOU must be responsible for your financial future.

- Always protect against losses.

- The only "good" investments are the ones that make you money.

- Always use a process to make investing decisions.

- Always trade using a structured set of rules.

- Continually measure the performance of your plan or system; there is always something that can be improved.

- Constantly pursue ways to reduce costs.

- Mastering your current situation requires you're educated in personal finance, market factors, and personal money management techniques.

- Improving your results requires improving your system; tools alone will not improve your profits.

- Learn from your mistakes (i.e. losses); you've already paid for them.

1st Principle of Investing Safely

You must be responsible for your financial future

You must control your money; No one else is, nor can they be, responsible for your financial future.

It is easy to find excuses when you give up control of your finances. And having someone or something to blame may feel good for a while.

It's the my broker's/spouse's/boss's/CEO's/Adviser's/Neighbor's fault. Or Wall Street's/Europe's/China's/Big Bank's/Corporate America's/President's/Republican's/Democrat's/Tea Party's fault.

But tomorrow, you will still have payments, debts, and expenses. In other words, blame does not pay the bills.

2nd Principle of Investing Safely

Always protect against losses

Always, always, always, cut your losses. And this rule doesn't just apply to investments.

Do not keep balances on high interest rate credit cards...this is a monthly loss. Do not pay monthly maintenance fees on checking accounts...this is also a monthly loss. Do not pay ATM fees...this is a per use loss. Do not hold on to losing positions, waiting for the market to turn around.

In all of the above, you'll end up spending a lot of time and effort just to break-even!

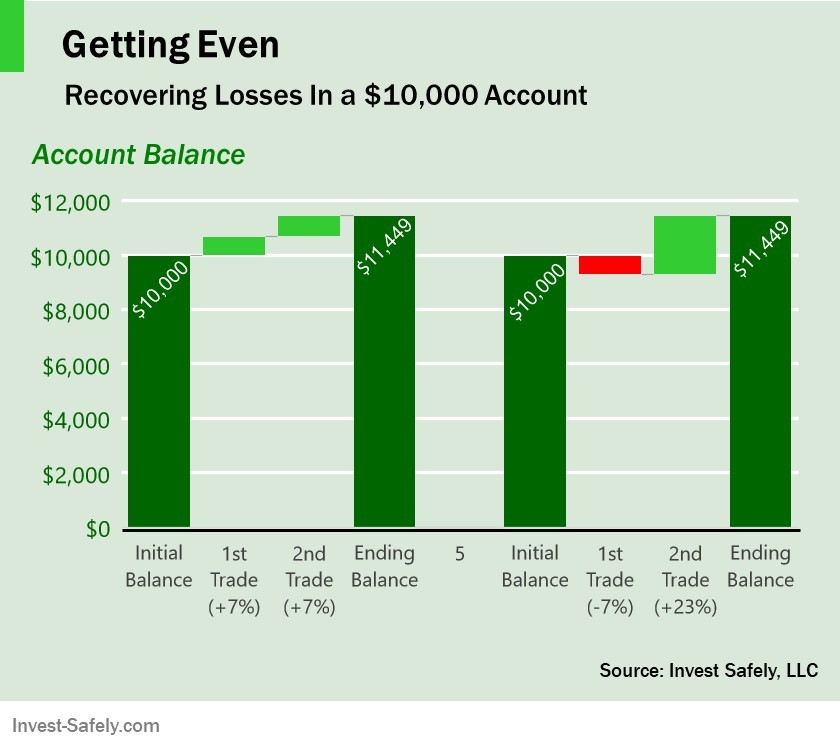

Time Required to "Catch-Up" after a One Year Loss of 7%

(Click the image for a deeper explanation of compound interest)

(Click the image for a deeper explanation of compound interest)

When it comes to investments, individual investors are at a disadvantage from the start.

Many financial experts refer to investing as a zero-sum game. In order for you to buy, some else has to sell. In order for you to make money, someone else has to lose money. This statement is only a half-truth!

Investing is a NEGATIVE-sum game. When you buy a stock, someone else does have to sell it to you. But neither of you play the game for free! The buyer and seller have a broker, and that broker charges BOTH sides commissions and fees.

If investing were zero sum, everything you gained or lost would go to the other person. Instead, you lose part of your gain to the broker, and the other person adds to his loss! Principle #2 is the reason the Principle #7 is so important!

3rd Principle of Investing Safely

The only "good" investments are the ones that make you money

All investments are bad until you sell them for a profit. Why? Because any time you have money in the market, you can lose that money.

Only after you sell can you can figure out whether you made a good investment. This is the reason that selling is also called "locking in your gains".

Learn how to buy AND how to sell!

4th Principle of Investing Safely

Always use a process to make investing decisions.

Do you know why NASCAR, MotoGP, and other motorsports garages have bright, white floors? Because with a white floor, it is very easy to see something that is out of place. Nuts, bolts, hoses, fluids, and anything else that should be ON the car or bike shows up immediately.

Your investing process can do the same thing for your money. At the start, your personal financial statements will show you where you're leaking money.

As you build experience, your track record will show you whether your investing and trading in the right places.

5th Principle of Investing Safely

Always trade using a structured set of rules.

Following rules is a key to repeatable investing success. When you invest the same way, over and over again, you'll quickly notice when things aren't going according to plan.

If you don't follow a structured set of rules, there is no way to know whether your system works or if you're just lucky.

6th Principle of Investing Safely

Continually measure the performance of your plan or system; there is always something that can be improved.

Peter Drucker, the father of management science, once said "what gets measured gets managed".

The same goes for investing. Look at your investing process and see what can be improved. Keep in mind that improving a system isn't always about profit and loss.

How much time do you spend on personal finances, investing, or trading? If you're spending every waking moment working on your investments, odds are there is room for improvement!

7th Principle of Investing Safely

Constantly pursue ways to reduce costs.

If you have a $50,000 retirement portfolio, and own 1 mutual fund that increases in price 4% a year. Let's say that mutual fund charges you a 1% "fee" (which is low). You'll never see the fee straightaway...instead, the mutual fund will just return 3%. 1% of your $2,000 profit (4% of 50,000) is $20 that you won't get.

But that is only for 1 fund, 1 year, and a lump sum of $50,000. What happens as your account grows to $500,000 or even $1,000,000 over a 20-30 year time frame? This is why it is so important to reduce costs.

8th Principle of Investing Safely

Mastering your current situation requires you're educated in personal finance, market factors, and personal money management techniques.

There are two situations everyone thinks about; where you are and where you want to be.

You need to have your starting point, or baseline, well defined if you plan to achieve your goals.

It is not enough to navel gaze about how you "wish" things were, or how you "think" things are...You need to know how things really are. Only then can you begin to change them.

Some say that a goal without a plan is just a dream. I say switch it up: Your financial dream is only a plan away.

9th Principle of Investing Safely

Improving your results requires improving your system; tools alone will not improve your profits.

Tools such as discount brokers, ETF's, hedge funds, trading platforms, etc. can all be very helpful to investing. However, a majority are set-up to keep you busy, rather than to make you money. If tools were guaranteed to make money, they'd say so.

That is why it is so important to improve your system. 20 years ago, people made money in the stock market without all the technology we have today.

How did they do it? They created a system for making decisions and then used the tools that were available.

Today's technology gives us more data, more often, more quickly. But all successful investors use a decision-making process to cut through noise and leverage all those tools into a money making opportunities.

10th Principle of Investing Safely

Learn from your mistakes (i.e. losses); you've already paid for them.

Admitting mistakes is hard. Admitting mistakes that involve money is almost impossible. Why? Because no one likes making mistakes in the first place. Throw some money in the mix, and you've created one of the most emotionally charged issues that exists.

If you have a long term view of investing, you know that the journey is going to be filled with some peaks and some valleys.

No comments:

Post a Comment